Congratulations! Your organization did the thing you set out to do. Whether that thing was a product or a service, you marketed it, made it, delivered it—and sold it. Whew! Now you can relax.

Congratulations! Your organization did the thing you set out to do. Whether that thing was a product or a service, you marketed it, made it, delivered it—and sold it. Whew! Now you can relax.

Not so fast.

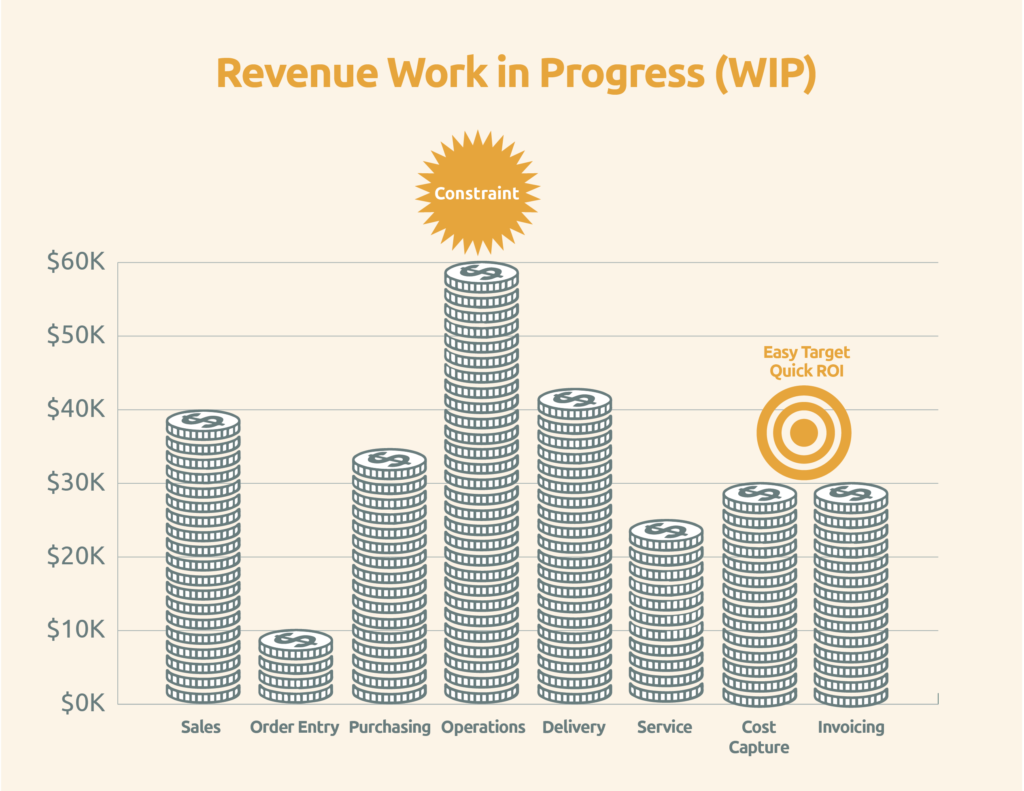

Have you collected yet? How long does it take your organization to capture costs and send an invoice? Waiting to receive payment after delivery of a product or service is the most expensive kind of work in process (WIP). You’ve made your entire investment in production, and now you’re carrying those costs with no return.

The expense of delayed invoicing is such a pervasive problem with organizations, in fact, that I make it the lone exception to my mantra of focusing on the constraint. If you want one quick lean strategy with a high ROI, tackling cost capture and invoicing is almost guaranteed to produce results.

One tried-and-true fix for invoicing is to reduce the variation of your products and services as much the market will allow in order to build standard work. Standard costs and standard delivery methods produce standard pricing and invoicing. For many routine products and services, billing is simultaneous with delivery. For example, when you have your car serviced, the service center has already created a product and service catalogue with set prices, and you sign your approval before work begins. Cost capture is complete, and you pay in order to get your car back.

But for organizations with high levels of variation, especially those that are not yet mature on their lean journey, delivery kicks off a long, messy, convoluted process of collecting revenue that drains the organization.

Are You Hiding a Mess in Invoicing?

Some organizations are so silo-focused on sales and operations that after the product is made or the service is rendered, they’re jumping forward to the next sale with no regard for whether cost has been captured or an invoice sent. The organization works slowly behind them, using invoicing processes that haven’t received the same attention as the process used to deliver the product.

It’s common to see those processes take dozens of inputs and handoffs over weeks before the actual invoice is generated. Operations must provide labor time and overtime for each skilled employee who participated. Purchasing has to reconcile purchase orders and provide the material costs, and someone has to analyze and add markups and overhead costs. This activity—often performed inaccurately and slowly—is itself an overhead cost that eats into profits.

When’s the last time you looked closely at your invoicing processes?

In my work with organizations, I’ve seen costs, errors, and delays in invoicing be the constraint to profitability. Or the constraint to viability in nonprofit organizations. Carrying costs needlessly is always a waste, and eliminating that waste cuts WIP and improves cash flow. (On an individual level, that’s why I created my own standard work for travel expense statements so nothing sits unreimbursed—and you should do the same!)

Even if your true constraint is actually in operations, or purchasing, or sales, it can still make sense to pursue invoicing first (see the illustration below). Let’s say your organization makes $180,000 a month, which means you make about $6,000 a day. Cash from a sale isn’t recognized until it’s collected, so if your cost capture and invoicing take 10 days, that equals $60,000 in WIP, not including the terms for paying the invoicing. If you could lean out your cost capture by 30%, you could create a one-time $18,000 benefit. What organization couldn’t use this interest-free cash infusion? It would help motivate and fund future lean improvements on other constraints.

The same goes for nonprofits that must be reimbursed for expenses and services, such as government agencies or universities. If the reimbursement process is slow and inaccurate, large amounts of operating funds are tied up in WIP—but if processes are improved, that frees up much-needed cash to support the mission.

The same goes for nonprofits that must be reimbursed for expenses and services, such as government agencies or universities. If the reimbursement process is slow and inaccurate, large amounts of operating funds are tied up in WIP—but if processes are improved, that frees up much-needed cash to support the mission.

Could Your Organization Use $100,000?

I discovered the importance of lean invoicing quite by accident many years ago, working with a client that wanted to try lean to correct a number of obvious problems. I started in the usual way: defining the mission and creating a high-level process map, which showed that the client’s constraint was in purchasing. Workflow had slowed or stopped due to lack of parts; purchasing was reactive, so much so that there was little time for forecasting. Purchases were expedited at higher cost for both materials and shipping. Inability to pay vendors on time actually generated credit holds in some cases.

My learnings and years of teaching told me to focus on purchasing exclusively, but the client was new to lean—and to me. They didn’t want to entrust such an important part of their organization to the new outsider, afraid they’d open a can of worms they wouldn’t be able to close. But they did want to give lean a shot, so they had me focus my facilitation on something simple: invoicing.

Was it simple? You be the judge.

The organization’s focus was solely on selling more services, treating cost capture and invoicing as an afterthought. The value stream map showed that invoicing took 80 steps and 30 handoffs, with a 50% rolled throughput yield (meaning the process had to go back a step to correct a defect at least half the time). Work was done in batches and divided alphabetically by customer last name, and no single person knew the whole process from start to finish. Completion time for each step was all over the place.

So the client team had their work cut out for them. But they pulled together to come up with a new process that dramatically cut costs and time, reduced variation, and improved accuracy— each by more than 60%. Besides the increased accuracy and profitability going forward, there was also an immediate effect: a one-time cash infusion of more than $100,000, which helped the client make more timely payments to vendors, meaning fewer parts on hold.

This promising turn of events actually gave the client confidence to try lean on the constraint, which led to much better execution, shorter lead times, more profit, and more customers. They decided to make lean a permanent part of their organization. And it all started with invoicing.

Think this would never happen in your organization? Be brave and take a peek at how many steps invoicing currently takes. Sample each step—is it accurate? Is there variation among the employees doing the work? How long does it take, and what’s the cost of each day that goes by? I can almost guarantee you’ll see an opportunity for improvement—and maybe even a substantial one-time infusion of cash. (Here’s a tip for finding support: get finance on your side. They really do want to pay vendors on time.)

Invoicing is a quick win that I’ve used successfully with several clients—some even going from unprofitable to profitable in weeks. If you’re looking for a place to test-drive lean, it’s a fantastic way to start.

Excellent advice Bill! I’ve seen similar success using Lean methodologies to reduce time in the contract process. We tend to introduce waste with non-value added approvals; non-standard language, services, fees and/or products; and especially when a change request is introduced. As you suggest, reviewing the value stream, identifying waste, and increasing the rolled throughput yield gets us to our revenue more quickly and with less effort:)

Comments are closed.